However if an individual opts for the payment gateway method on the e-filing portal to make income tax payments then certain charges may be applicable if they opt for such a payment method. Advance Ruling Forms in GST.

Browse Our Example Of Construction Tax Invoice Template Invoice Template Invoice Example Invoice Template Word

Click on the link to view the issue of interest to you.

. Self-assessed tax referred to under section 75 of the CGST Act shall also cover the outward suppliessales as reported in the GSTR-1 under Section 37 of the CGST Act but which has been missed out while reporting in the GSTR-3B under Section 39. CAs experts and businesses can get GST ready with Clear GST software certification course. 172022 dated 1st August 2022.

Our Goods Services Tax course includes tutorial videos guides and expert assistance to help you in mastering Goods and Services Tax. Amount of tax to be indicated in tax invoice and other documents. For GST Luxury Car Tax and Wine Equalisation Tax purposes from 1 July 2015 where the term Australia is used in this document it is referring to the indirect tax zone as defined in subsection 195-1 of the GST Act.

One having a tax invoice. B does not issue an invoice charging GST 12 from the service recipient. Prakash Matre at September 12 2022.

List Of All GST Forms. This is a register of food issues the ATO has determined. Any system verifies the authenticity of an invoice by using this unique number as reference.

And c supplies the service to a body corporate. The government has enabled the option of making payments via credit card UPI and Net banking on the e-filing income tax portal. Our GST Software helps CAs tax experts business to manage returns invoices in an easy manner.

To access your previous 13 months of bills select View previous bills. An advance ruling only applies to the applicant and the particular arrangement that was the subject of the ruling request and where applicable to the years or periods and provisions of the Income Tax Act 1947 stated in the ruling. GST is payable on a self-assessment.

The Goods and Service Tax GST Council has recommended hiking the GST rates on. Application Form For Advance Ruling. IRN is generated by the e-invoice system after a business taxpayer uploads their invoice details or gets it done via a GSP.

To view your bills sign in to My Telstra using your Telstra IDIf youve forgotten your Telstra ID username or password you can reset it. You invoice the tenant based on the gst exempt amount of 500 50 gst you pay insurer 500 40 gst you collect 500 50 gst remit 10 to ATO. Enter the GSTIN mentioned on the invoice in the search box and followed by captcha Final click enter to view the details.

A supplier cannot take Input Tax Credit of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax under reverse charge. Your invoices must take into account the gst already included in the original invoice sad you cannot charge gst on top of the gst. Service tax accumulated till June 30 2017 before the new goods and services tax GST was put in place.

When can a Demand Under GST be Raised by the Tax Authorities. It binds the Comptroller of Income Tax to apply the relevant provisions of the Income Tax Act 1947 in the manner that was set out in. Division 156 - supplies and acquisitions made on a progressive or periodic basis.

Right To Serviceसव क अधकर Auction Who is Who Webinar on e-invoice Download list of taxpayers eligible for e-invoice From 20th April 2018 in Uttarakhand State it is mandatory to generate e-way bill for intra-state movement of taxable goods of value above Rs 50000-. Prohibition of unauthorised collection of tax. TAX INVOICE CREDIT AND DEBIT NOTES.

However the GST treatment of such reimbursements depends on the arrangements entered into between the Contractor and the Customer and such arrangements may be shown in different ways on the tax invoice. E-Invoicing is mandatory for the taxpayers with annual turnover more than Rs10 crores from 01st October 2022 vide Notification No. Go to Payments at the top of the screenA list of your billing accounts will be displayed select Download PDF bill on the relevant account.

List Of All GST Forms. Every IRN is unique in the GST system irrespective of the taxpayer financial year and document type. This is an interesting issue and the GST implications depend on both commercial issues and GST technical interpretation.

FREE GST INVOICE GENERATOR Generate GST Compliant Invoices for FREE. However many aspects remained unresolved and petitioners moved to court filing reaching the high court seeking to scrap Rule 117 of CGST Rules 2017 which provides a time limit to carry forward tax credit. FORM GST ARA -01.

The concept of Goods and Service Tax GST was made applicable in India on 1st July 2017. Facility of digital payment to recipient. Input Tax Credit under RCM.

You only remit the difference in your BAS. Not to serve the notice period while leaving their current job as per a report issued by the Authority of Advance Ruling AAR. Attributing GST payable or an input tax credit arising from a.

Credit and debit notes. Corporate card statements - entitlement to an input tax credit without a tax invoice GST Ruling.

Gst Turnover Threshold Goods And Service Tax The Next

How To Revise Invoice In Gst Important Things To Know

Formats Of Tax Invoice And Bill Of Supply As Per Gst Act Invoice Template Word Invoice Format Certificates Online

Professional Template Gst Invoice Format In Excel Download Xlsx File Invoice Format Invoice Format In Excel Excel

Gst Tax Invoice Format In Excel Gst Tax Invoice Format Exe Invoice Format In Excel Invoice Format Invoice Template Word

All About Gst E Invoice Generation System On Portal With Applicability

Gst Tax Invoice Format In Excel Word Pdf And Pdf Invoice Format In Excel Invoice Template Word Invoice Format

Blank Invoice Template Of Gst Invoice Format In Excel Download Xlsx File Invoice Format Invoice Format In Excel Invoice Template

Free Excel Invoice Template Gst Invoice Format Invoice Format In Excel Invoice Template

Invoice Template Nz Blank Invoice Template Tax Invoice Template For New Zealand Invoice Template Invoice Template Invoice Example Invoicing Software

The New Format For Invoices To Be Issued For Supply Of Goods Under Gst Invoicing Invoice Format Format

Gst Invoice Format Rules Download Sample Tax Invoice Indiafilings

Gst Invoice Goods And Service Tax Invoice Sample Goods And Services

Simple Gst Invoice Format In Pdf1 Simple Invoice Template Word Details Of Simple Invoice Template Wor Invoice Template Word Invoice Format Invoice Template

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format Invoice Format In Excel Invoice Template Word

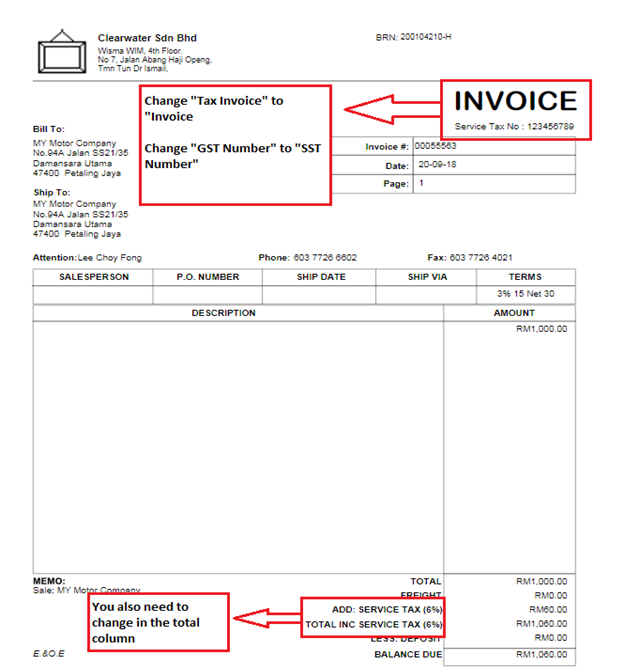

Sst Customized Form Abss Support

Invoice Template Ideas Invoice Format In Excel Invoice Format Invoice Template Word

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format Invoice Format In Excel Invoice Template

Download Excel Format Of Tax Invoice In Gst Gst Invoice Format With Regard To Australian Invoice T Invoice Format Invoice Format In Excel Invoice Template Word